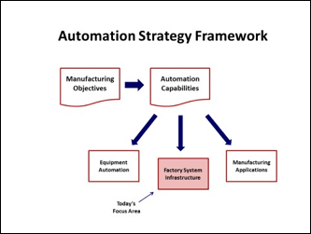

In my October 27th blog, I wrote about the Equipment Automation topic shown in the figure below and stressed the importance of developing good equipment purchasing specifications from the outset to ensure the company’s manufacturing objectives can be met. Given the number of EDA pilot and production projects currently active across the industry, it’s likewise important to consider what kind of Factory System Infrastructure will be necessary to support a full-scale EDA deployment… so the purpose of this posting is to highlight this topic for the semiconductor manufacturing IT professionals who may face these challenges soon.

However, before diving into a detailed design process for an EDA factory system, you must decide what overall system architecture will govern that design. A number of factors go into this decision, including 1) the functional requirements that distinguish EDA-based data collection from other more traditional approaches, 2) technology constraints of the existing factory systems, 3) budget limitations, 4) schedule requirements, and especially 5) the non-functional requirements (scalability, performance, reliability, ease-of-use, etc.) that often make the difference between success and failure of a given system.

However, before diving into a detailed design process for an EDA factory system, you must decide what overall system architecture will govern that design. A number of factors go into this decision, including 1) the functional requirements that distinguish EDA-based data collection from other more traditional approaches, 2) technology constraints of the existing factory systems, 3) budget limitations, 4) schedule requirements, and especially 5) the non-functional requirements (scalability, performance, reliability, ease-of-use, etc.) that often make the difference between success and failure of a given system.

Each of these factors deserves a thorough treatment of its own, but since we were invited to address this topic at a recent seminar sponsored by SEMI Taiwan, we’ve assembled an overview presentation entitled “Factory Systems Architectures for EDA” that you can use as a starting point. It not only covers in more depth the requirements above which drive key architectural decisions, but also suggests what some of the major architectural components of a production system would need to be, based on the experience Cimetrix has gained working with the earliest adopters of EDA across the semiconductor device maker and equipment supplier communities. These include provisions for handling the scores of equipment metadata models that will exist in a production facility, for creating and managing the thousands of data collection plans that are resident at the equipment instances themselves, for monitoring and maintaining the overall performance of a system with such inherent flexibility, and for a number of other examples. Finally, the presentation describes some high-level examples of architectural “styles” that have been implemented in the industry thus far.

We sincerely hope you will download this presentation and its companion “The Power of E164: EDA Common Metadata” that was also presented at the SEMI Taiwan event, and contact us when you want to know more about any of these topics.♦

The World Cup is one of the greatest sporting events around the globe - and, for many parts of the world, it is THE sporting event of the year. This year, ABC & ESPN experienced an 80% gain in viewers during the opening matches... and the team at Cimetrix definitely helped contribute to that statistic. An avid fan, Cimetrix's CEO, Bob Reback, spearheaded the "soccer spirit" and organized several gatherings to view the matches.

The World Cup is one of the greatest sporting events around the globe - and, for many parts of the world, it is THE sporting event of the year. This year, ABC & ESPN experienced an 80% gain in viewers during the opening matches... and the team at Cimetrix definitely helped contribute to that statistic. An avid fan, Cimetrix's CEO, Bob Reback, spearheaded the "soccer spirit" and organized several gatherings to view the matches.

Fabs are like people, each one has it own personality traits. Fortunately, and arguably unfortunately, unlike people, most fabs have a handbook for their “personalities” in the form of specifications. I have found it interesting, that like people, fab “personalities” have common and unique features. Here are a few of examples:

Fabs are like people, each one has it own personality traits. Fortunately, and arguably unfortunately, unlike people, most fabs have a handbook for their “personalities” in the form of specifications. I have found it interesting, that like people, fab “personalities” have common and unique features. Here are a few of examples: